- Network After Work

- Posts

- 🤝Master the LinkedIn Content Strategy That Drives Sales

🤝Master the LinkedIn Content Strategy That Drives Sales

Upcoming Events

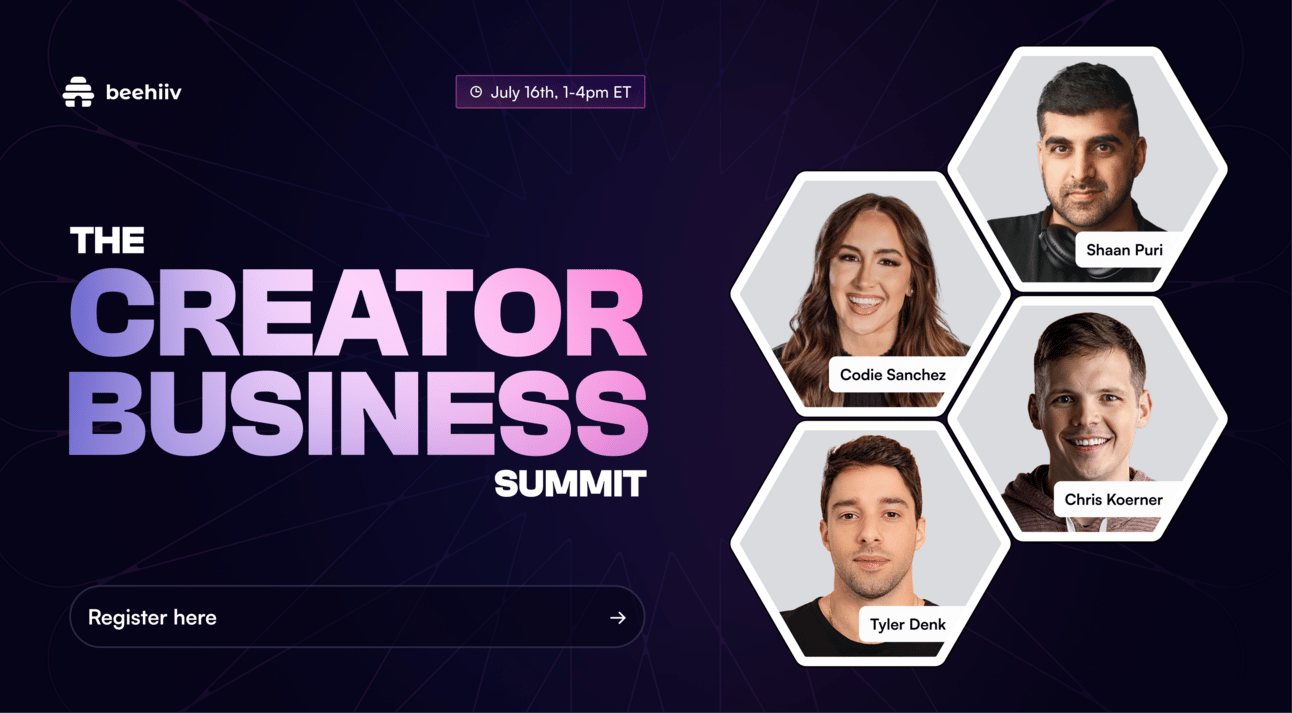

The Creator Business Summit July 16th | 1pm ET |  The LinkedIn Content Roadmap 3-Day Workshop July 28th-30th | 12pm ET |

Together with Gelt

The Big Beautiful Bill Is Here and Your Taxes Will Get Affected Big Time — Now is the Moment to Get Expert CPA Guidance and Strategy to Make Sure You Stay Ahead of the Game

It's time to dump your current CPA situation. With the OBBB approved, now is your window to act. If you're growing your business or investments, Gelt pairs you with in-house CPAs and an AI-powered platform to reduce taxes year-round, not just at tax season. Real strategy, not just filing.

Business News

Apple Bets Big on Homegrown Magnets

Apple just dropped a cool $500 million to lock down a steady supply of American-made rare earth magnets and strengthen its made-in-the-USA credibility while they’re at it. In a new multiyear deal with MP Materials, Apple will source neodymium magnets from MP’s shiny Fort Worth, Texas factory (custom-built for Apple products, naturally), and partner on a cutting-edge recycling facility in California to turn old gadgets into shiny new parts.

It’s all part of Apple’s pledge to pump over $500 billion into the U.S. economy in the next four years and keep rare earth jobs, technology, and ingenuity on American soil. Beyond just magnets in your iPhone and MacBook, the deal includes training a fresh workforce, scaling up domestic manufacturing, and proving that sustainability and innovation can actually play nice together. In Tim Cook’s words: “We couldn’t be more excited about the future of American manufacturing.”

JPMorgan Finds Its Mojo

JPMorgan kicked off earnings season with a better-than-expected second quarter, proving Wall Street still knows how to make money even when the political winds are wild. Investment banking revenue jumped 8%, thanks to a revival in mergers and equity deals, while trading desks thrived on tariff-induced market chaos. Jamie Dimon called the U.S. economy “resilient” but threw in his usual warnings about tariffs, geopolitics, and sky-high asset prices because of course he did.

Despite a headline net income drop (blame a one-time Visa gain last year), profits actually rose 9% when you adjust for that. CFO Jeremy Barnum summed it up with, “We’re firing on all cylinders,” and for once, that doesn’t feel like spin. Wells Fargo and Citigroup also saw investment banking gains, though Wells’ guidance stumble sent its stock tumbling. Bottom line: a few hot IPOs, loosened D.C. rules, and some market drama have Wall Street feeling… cautiously optimistic, with JPMorgan leading the pack.

Reply