- Network After Work

- Posts

- 🤝 Secret LinkedIn Algorithm Hacks to Dominate in 2026!

🤝 Secret LinkedIn Algorithm Hacks to Dominate in 2026!

Upcoming Events

How to Earn More in 30 Minutes a Day with Digital Farming January 22nd | 2pm ET |  Secret LinkedIn Algorithm Hacks to Dominate in 2026! January 28th | 2pm ET |

Try Wispr Flow Today

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Business News

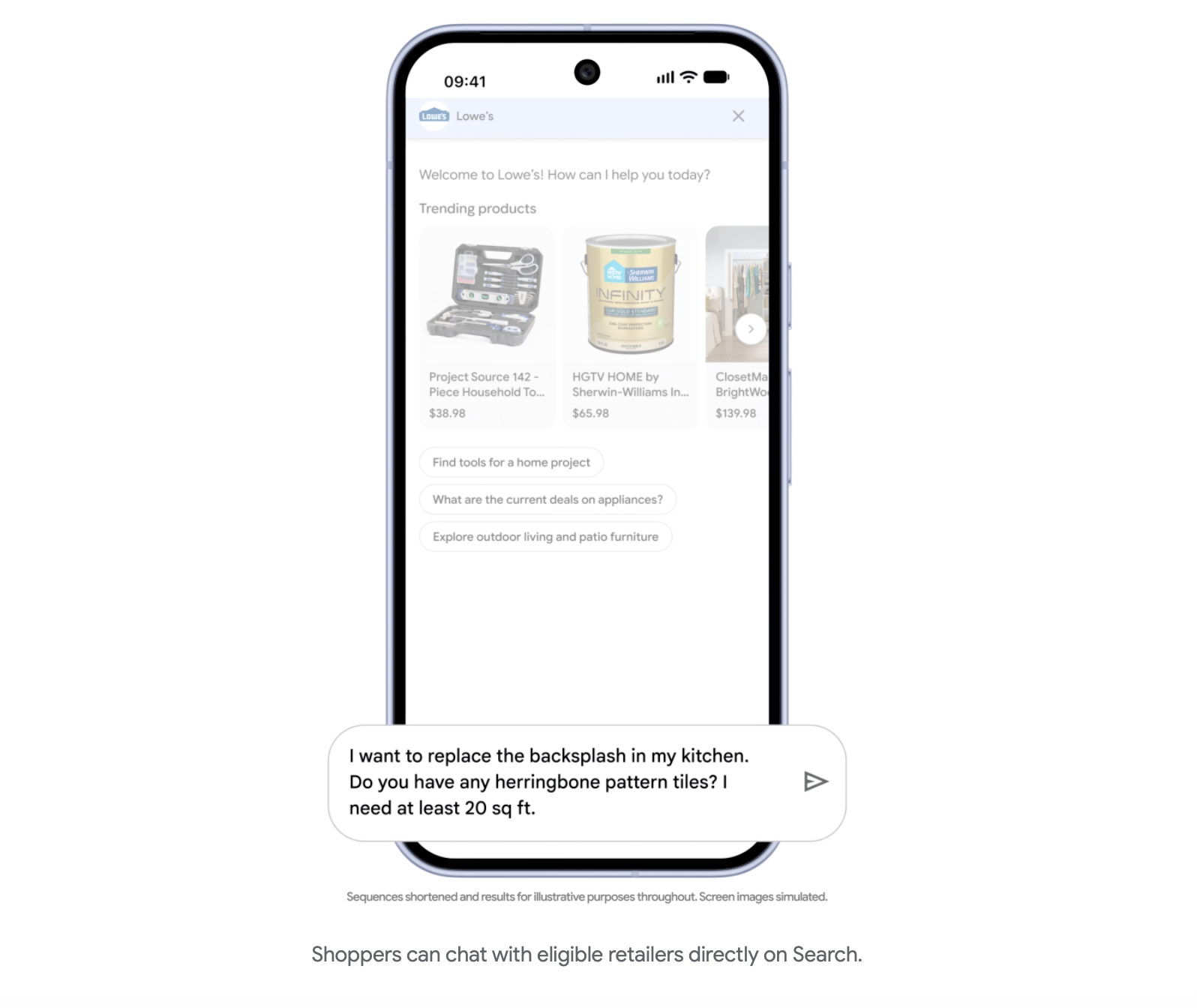

Google Launches a New AI Standard for Online Shopping

Image Credit: Google

Google announced the launch of the Universal Commerce Protocol (UCP), a new open-source system designed to help retailers use AI across the entire shopping experience. UCP acts as a shared framework that connects product discovery, checkout, payments, and post-purchase support, so retailers don’t have to build and maintain separate tools for each step. The goal is to make AI-powered shopping easier to scale and more consistent, while giving businesses flexibility in how they use it. Google says the protocol will soon enable direct purchases inside its AI products, alongside new features like brand chat experiences and AI-triggered discounts, signaling a bigger push to become a central layer in how online commerce works going forward.

Credit Card Rate Cap Proposal Rattles Financial Stocks

Financial stocks fell Monday after Trump called for a one-year cap of 10% on credit card interest rates, a move that immediately pressured banks and card issuers most exposed to consumer lending. Shares of Capital One and Synchrony Financial led declines, while diversified banks and payment networks like Visa and Mastercard posted smaller losses; American Express also slid. Trump said the cap would take effect January 20, 2026, though it would require congressional approval. Supporters point to bipartisan interest in curbing fees, but critics warn the policy could shrink access to credit, reduce consumer spending, and force banks to pull back especially for borrowers with weaker credit—potentially reshaping rewards programs and pushing some consumers toward alternative lenders like buy-now-pay-later services.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Tip of the Day

Optimize what already works before chasing something new.

Look at your top-performing offer, email, or channel and ask, “How can I get 10% more from this?” Small optimizations compound faster than starting from zero.

Reply